It’s time to check in with the macro picture, to get an idea of just where markets are headed in the coming months. That’s what a JPMorgan global research team, headed up by Joyce Chang, has been doing.

The JPM team starts by noting the sell-off in US Treasury bonds last week, pushing up yields as investors acted in response to inflationary fears. However, the rise in bond yields steadied on Friday, and Chang’s team does not believe that inflation is the great bugaboo it’s made out to be; her team sees a combination of economic growth and fiscal stimulus creating a virtuous circle of consumer spending fueling more growth.

They write, “Our global economics team is now forecasting US nominal GDP to average roughly 7% growth over this year and next as targeted measures have been successful in addressing COVID-19 and economic activity is not being jeopardized. Global growth will exceed 5%...”

What this means, in JPM’s view, is that the coming year should be good for stocks. Interest rates are likely to remain low, in the firm’s estimation, while inflation should moderate as the economy returns to normal.

JPM’s stock analysts have been following the strategy team, and seeking out the stocks they see as winners over the next 12 months. Three of their recent picks make for an interesting lot, with Strong Buy ratings from the analyst community and over 50% upside potential. We’ve used the TipRanks database to pull the details on them. Let’s take a look.

On24 (ONTF)

The first JPM pick were looking at here is On24, the online streaming service that offers third parties access for scaled and personalized networked events. In other words, On24 makes its streaming service available for other companies to use in setting up interactive features, including webinars, virtual events, and multi-media experiences. The San Francisco-based company boasts a base of more than 1900 corporate users. On24’s customers engage online with more than 4 million professionals every month, for more than 42 million hours every year.

As can be imagined, On24 saw a surge of customer interest and business in the past year, as virtual offices and telecommuting situations expanded – and the company has now used that as a base for going public. On24 held its IPO last month, and entered the NYSE on February 3. The opening was a success; 8.56 million shares were put on the market at $77 each, well above the $50 initial pricing.

However, shares have taken a beating since, and have dropped by 36%. Nevertheless, JPM’s Sterling Auty thinks the company is well-placed to capitalize on current trends.

“The COVID-19 pandemic, we believe, has changed the face of B2B marketing and sales forever. It has forced companies to move most of their sales lead generation into the digital world where On24 is typically viewed as the best webinar/webcast provider.” the 5-star analyst wrote. “Even post-pandemic we expect the marketing motion to be hybrid with digital and in-person being equally important. That should drive further adoption of On24-like solutions, and we expect On24 to capture a material share of that opportunity.”

In line with these upbeat comments, Auty initiated coverage of the stock with an Overweight (i.e., Buy) rating, and his $85 price target suggests it has room for 73% upside over the next 12 months. (To watch Auty’s track record, click here.)

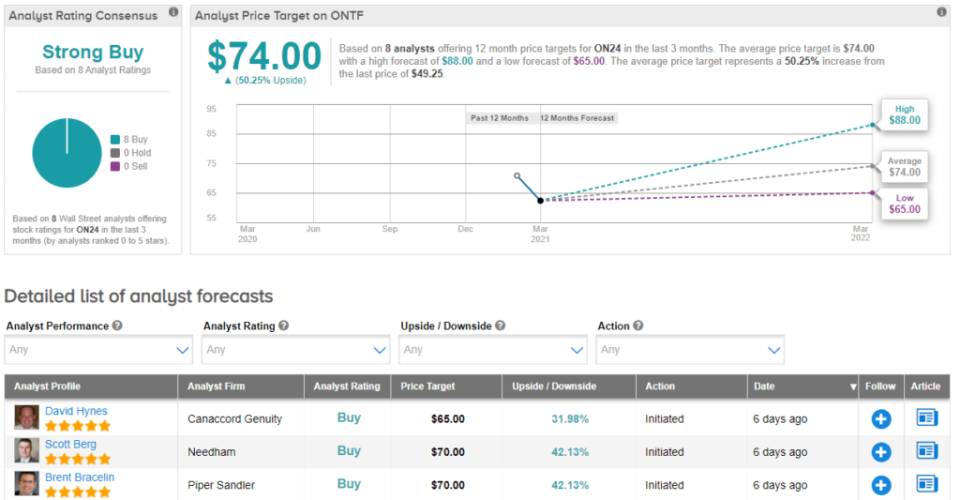

Sometimes, a company is just so solid and successful that Wall Street’s analysts line up right behind it – and that is the case here. The Strong Buy analyst consensus rating is unanimous, based on 8 Buy-side reviews published since the stock went public just over a month ago. The shares are currently trading for $49.25 and their $74 average price target implies an upside of 50% from that level. (See On24’s stock analysis at TipRanks.)

Plug Power, Inc. (PLUG)

And moving over to the reusable energy sector, we’ll take a look at a JPM ‘green power’ pick. Plug Power designs and manufactures hydrogen power cells, a technology with a great deal of potential as a possible replacement for traditional batteries. Hydrogen power cells have potential applications in the automotive sector, as power packs for alt-fuel cars, but also in just about any application that involves the storage of energy – home heating, portable electronics, and backup power systems, to name just a few.

Over the past year, PLUG shares have seen a tremendous surge, rising over 800%. The stock got an additional boost after Joe Biden’s presidential election win – and his platform promises to encourage ‘Green Energy.” But the stock has pulled back sharply recently, as many over-extended growth names have.

Poor 4Q20 results also help explain the recent selloff. Plug reported a deep loss of $1.12 per share, far worse than the 8-cent loss expected, or the 7-cent loss reported in the year-ago quarter. In fact, PLUG has never actually reported positive earnings. This company is supported by the quality of its technology and that tech’s potential for adoption as industry moves toward renewable energy sources – but we aren’t there yet, despite strides in that direction.

The share price retreat makes PLUG an attractive proposition, according to JPM analyst Paul Coster. “In the context of the firm's many long-term growth opportunities, we believe the stock is attractively priced at present, ahead of potential positive catalysts, which include additional ‘pedestal’ customer wins, partnerships and JVs that enable the company to enter new geographies and end-market applications quickly and with modest capital commitment,” the analyst said. “At present, PLUG is a story stock, appealing to thematic investors as well as generalists seeking exposure to Renewable Energy growth, and Hydrogen in particular.”

Coster’s optimistic comments come with an upgrade to PLUG’s rating - from a Neutral (i.e., Hold) to Overweight (Buy) - and a $65 price target that indicates a possible 55% upside. (To watch Coster’s track record, click here.)

Plug Power has plenty of support amongst Coster’s colleagues, too. 13 recent analyst reviews break down to 11 Buys and 1 Hold and Sell, each, all aggregating to a Strong Buy consensus rating. PLUG shares sell for $39.3 and have an average price target of $62.85, which suggests a 60% one-year upside potential. (See Plug’s stock analysis at TipRanks.)

Orchard Therapeutics, PLC (ORTX)

The last JPM stock pick we’ll look at is Orchard Therapeutics, a biopharma research company focused on the development of gene therapies for the treatment of rare diseases. The company’s goal is to create curative treatments from the genetic modification of blood stem cells – treatments which can reverse the causative factors of the target disease with a single dosing.

The company’s pipeline features two drug candidates that have received approval in the EU. The first, OTL-200, is a treatment for Metachromatic leukodystrophy (MLD), a serious metabolic disease leading to losses of sensory, motor, and cognitive functioning. Strimvelis, the second approved drug, is a gammaretroviral vector-based gene therapy, and the first such ex vivo autologous gene therapy to receive approve by the European Medicines Agency. It is a treatment for adenosine deaminase deficiency (ADA-SCID), when the patient has no available related stem cell donor.

In addition to these two EU-approved drugs, Orchard has ten other drug candidates in various stages of the pipeline process, from pre-clinical research to early-phase trials.

Anupam Rama, another of JPM’s 5-star analysts, took a deep dive into Orchard and was impressed with what he saw. In his coverage of the stock, he notes several key points: “Maturing data across various indications in rare genetic diseases continues to de-risk the broader ex vivo autologous gene therapy platform from both an efficacy / safety perspective… Key opportunities in MLD (including OTL-200 and other drug candidates) have sales potential each in the ~$200-400M range… Importantly, the overall benefit/risk profile of Orchard’s approach is viewed favorably in the eyes of physicians. At current levels, we believe ORTX shares under-reflect the risk-adjusted potential of the pipeline...”

The high sales potential here leads Rama to rate the stock as Outperform (Buy) and to set a $15 price target, implying a robust 122% upside potential in the next 12 months. (To watch Rama’s track record, click here.)

Wall Street generally is in clear agreement with JPM on this one, too. ORTX shares have 6 Buy reviews, for a unanimous Strong Buy analyst consensus rating, and the $15.17 average price target suggests a 124% upside from the current $6.76 trading price. (See Orchard’s stock analysis at TipRanks.)

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.